We're exhibiting at E-World | Register & Secure your Meeting

Germany, Essen | 11-13 February

Germany, Essen | 11-13 February

20 December 2023

Charlie Robertson

The Guardian’s claim relates to REDD+ projects, previously the largest project type represented in the voluntary carbon market, which issue credits by protecting trees that would otherwise have been deforested. While carbon markets have long been hailed as a mechanism that can close the conservation finance gap, the Guardian’s article at the beginning of 2023 threw the efficacy of this mechanism into question, largely on the basis of West et al.’s highly critical study of REDD+ projects.

This new study, led by Prof. Ed Mitchard (Chief Scientist, Space Intelligence), claims that there were “serious errors” in the original publication cited by the Guardian, stemming from a combination of “numerical errors” and “completely inappropriate” control areas used to establish what would have happened to the protected forest in the absence of a carbon project.

Ultimately, the main takeaway is something that industry insiders have known for a long time –Verra’s old REDD+ methodology was too vulnerable to being gamed by bad actors, but at the same time there are projects out there which have genuinely delivered on halting deforestation (sometimes disproportionately well compared to how many credits they’ve issued).

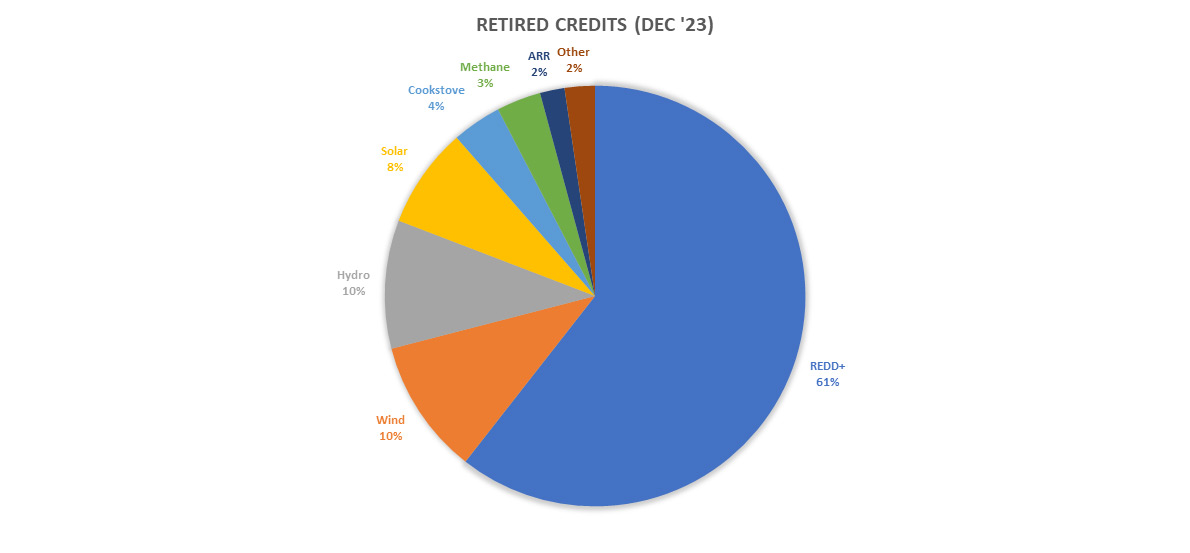

The fundamental case for REDD+ projects remains too strong to ignore – it is more cost-effective to protect trees than to re-plant them. Market participants seem to have remembered this fact, with REDD+ credits making up the majority of all credit retirements in December so far, as seen above. Hopefully this new study, in combination with the release of Verra’s updated REDD+ methodology, will mark the beginning of the REDD+ market delivering on the promise of channelling finance to the world’s forests at the scale required to keep the 1.5 degrees pathway alive.

CFP Energy is pleased to announce the appointment of Ken Kawase as the new Head of Commercial. Ken brings over 14 years of extensive experience in the energy commodities sector.

CFP Energy is pleased to announce the appointment of Jarek Kozlowski as its new Chief Financial Officer (CFO).

As the UK ETS Authority launches another consultation to generate stakeholder Input, (bringing the total to 14 in the last year), UK ETS participants are highlighting a sense of “consultation fatigue” and call for greater clarity on what lies ahead for reform of the UK ETS.