We're exhibiting at E-World | Register & Secure your Meeting

Germany, Essen | 11-13 February

Germany, Essen | 11-13 February

20 August 2024

George Brown

With 20+ years of trading experience under his belt, covering a variety of markets and industries, Tim now helps organisations navigate the complexities of carbon markets, offering businesses a clear perspective and highly bespoke approach to decarbonisation.

In this feature guide, CFP Energy provides context and insights into carbon compliance, shining a light on the tightening grip of carbon regulations and the future development of carbon markets.

For immediate support and access to carbon allowances, you can connect with Tim and his team, here.

For one of the UK’s leading carbon traders and experts, a shift of seismic proportions is appearing on the horizon for UK and European businesses.

“It’s a fairly new kind of marketplace and one that is difficult to navigate and understand,” said Tim.

“The media fail to provide accurate context and analysis of carbon markets when assessing the role they play in decarbonisation. When you actually look at the big carbon picture, there are incredibly positive and encouraging signs of progress in renewable power generation and lowering emissions in key areas.”

In simple terms, carbon compliance markets are systems where companies can buy or sell carbon allowances to meet regulatory limits on carbon emissions, helping to reduce overall greenhouse gases.

For example, if a large organisation emits carbon into the atmosphere, it must buy carbon allowances from a dedicated commodities market in order to comply with international and national level emission regulations.

“Even organisations that are bound by regulations struggle to make sense of carbon price fluctuations and are often stung as a result. They have to comply and so, have a vested interest in reducing their emissions but the technology and fuel alternatives aren’t there yet. We have to provide greater education in order for progress to be made on carbon emissions.”

“It’s a volatile commodity market so there are a variety of forces that impact prices, some of which are unpredictable while others, like the publication of regulations, can be anticipated. My team work hard to secure the best deal for our partners depending on their specific industry and location.”

For airline operators, car manufacturers, industrial giants and other businesses that are responsible for the highest levels of carbon emissions, EU and UK trading schemes are necessary for navigating regulations.

Tim’s approach and understanding of the sector is key for his partners and clients, who rely upon his advice to save millions of pounds while navigating and complying with carbon regulations.

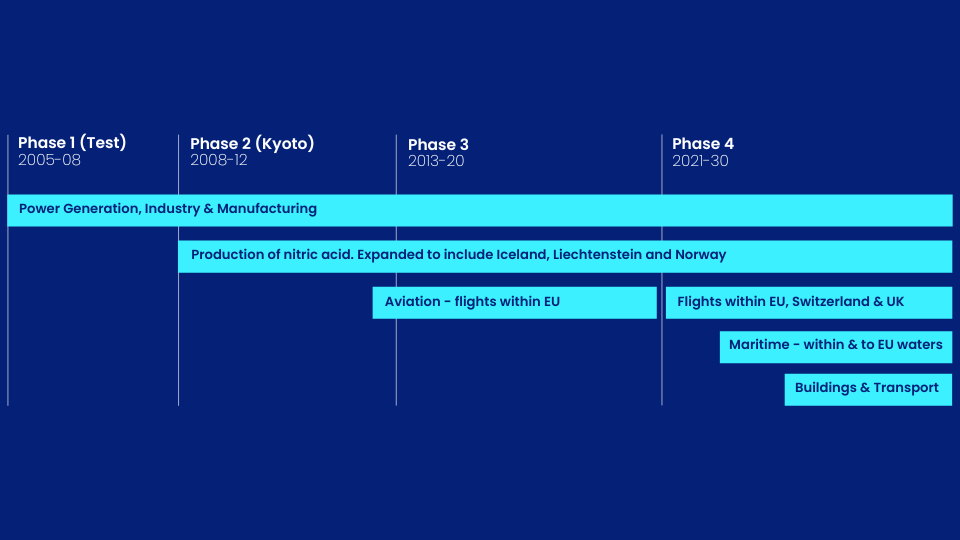

Alongside the growing impact of market forces, both the UK and EU ETS schemes are set to expand in scope. While even more industries are being brought into line to combat emissions. In order to support organisations across the UK and EU, CPF Energy has steadily grown its capabilities and team since 2006.

.png)

The largest organisations on the planet are ploughing millions into the mitigation of carbon emissions, and as regulations become more and more strict, greater resources will have to be allocated towards carbon allowances.

This will only create greater demand for allowances and drive-up prices in the both the EU and the UK markets.

The EU ETS works on the 'cap and trade' principle. A cap is set on the total amount of greenhouse gases that can be emitted by the operators covered by the system. The cap is reduced over time so that total emissions fall.

Within the cap, operators buy or receive emissions allowances, which they can trade with one another as needed.

The EU ETS covers around 40% of the EU's greenhouse total gas emissions as the highest emitters are bound by this specific scheme.

Smaller scale emitters are still required to reduce their emissions by specific regulations in countries across Europe and the UK, such as ESOS Phase 3 or nEHS and as time moves on, the scope of emissions regulations will grow, demanding that organisations take action to reduce carbon and their reliance on traditional fuels.

Tim continued: “The EU pioneered the ETS and it’s been an effective way of balancing emissions and driving innovation in green technology to remove carbon from the atmosphere. One allowance represents one tonne of carbon and some organisations require thousands of allowances in order to comply with regulations. At some points in time, there is a surplus of allowances, in others there is greater scarcity which drives price changes.”

.png)

“Businesses in the UK are no longer bound by the European-based Emissions Trading Scheme (ETS) following Brexit. As a result, the UK ETS has been established and organisations based in Britian can only access a specific marketplace with its own prices and regulations.”

With the deployment of renewable energy growing, many big emitters may be able to reduce their direct emissions and reduce their reliance on the carbon market to balance their carbon.

“In 2023, we saw a 10% increase in renewable energy generation,” said Tim.

“And the signs are all pointing in the right direction as far as wind and solar power is concerned. On a particularly blustery day, up to 70% of the UK’s energy could be covered by wind turbines. I think it’s an incredible achievement to have such a capability and it also means that there isn’t a speck of carbon emitted from turning a natural energy resource (wind) into power. Whereas with the burning of coal, oil and gas, it’s a different story.”

.png)

“Carbon markets are incredibly complex.” Said Tim. “Much like the delicacy of food supply chains or the issues relating to power consumption and carbon emissions from large industrial operators, EU and UK ETS needs expert management and guidance.

We’re trying to expedite the net zero challenge but there are major hurdles to overcome and forecast when it comes to emissions regulations and market forces.”

Despite the challenges and associated complexities, Tim and his team forecast a radical shift to take place as regulations continue to tighten across Europe.

Carbon allowances will only increase in price, which should drive fundamental change in ETS compliance strategy while greater carbon abatement opportunities will be explored with technology innovations.

“It’s an interesting sector to be involved in and I believe that we’re providing a realistic and genuine path towards net zero. We can’t just snap our fingers and stop using traditional fuels or emitting carbon into the atmosphere but we can take a steps to get there eventually.”

"But the bottom line is this. If companies do not plan for tighter regulations and higher carbon allowance costs, they may not be able to continue operating into a future that demands sustainable and green operations."

For access to carbon markets and a consultation with Tim and his team, get in touch here.

CFP Energy is proud to have been recognised in the Environmental Finance Environmental Market Rankings 2025.

CFP Energy is proud to have been recognised in the Environmental Finance Environmental Market Rankings 2025.

Decarbonising the Future: ETS Reforms & Net Zero Solutions - The latest industry report from CFP Energy features the insights of John Booth as well as the results of a survey of data centres across the UK, France and Germany. Operators were questioned on their net zero progress and future outlook for decarbonising their operations.