We're exhibiting at E-World | Register & Secure your Meeting

Germany, Essen | 11-13 February

Germany, Essen | 11-13 February

8 January 2024

Jaclyn Foss

The Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), by the International Civil Aviation Organization (ICAO), is a comprehensive global initiative aimed at curbing carbon dioxide emissions from international air travel.

The primary goal is to keep the aviation sector’s net CO2 emissions from international flights below 2019 levels, thereby supporting the broader aim of achieving carbon-neutral growth in international aviation starting in 2021. Under CORSIA, airlines are mandated to offset any CO2 emissions exceeding the baseline figure, defined as 85% of 2019’s emissions from international aviation, by purchasing CORSIA-compliant carbon credits.

This new phase brings not only compliance responsibilities but also strategic challenges and opportunities in the carbon credit market, as airlines strive to align their operations with environmental commitments. Here, CFP Energy plays a vital role, offering guidance and tailored solutions to help airlines stay ahead of the curve to navigate these new waters, meet upcoming deadlines and be confident in their CORSIA-aligned carbon credit purchase plan.

Scope: CORSIA targets international flights. It does not cover emissions from least developed countries, small island developing states, and landlocked developing countries, although these states can volunteer to take part.

Emissions Reporting: Participating airlines emitting over 10,000 tonnes of CO2 annually must report their international flight emissions yearly by monitoring their fuel use per flight. They may do so by using an approved method or, in some cases, estimate by using ICAO’s simplified CO2 Reporting Tool (CERT). Before submitting to states, emissions reports require verification by specific accredited bodies. States will submit aggregated emissions to ICAO, which will publish operator-specific and state-aggregated emissions.

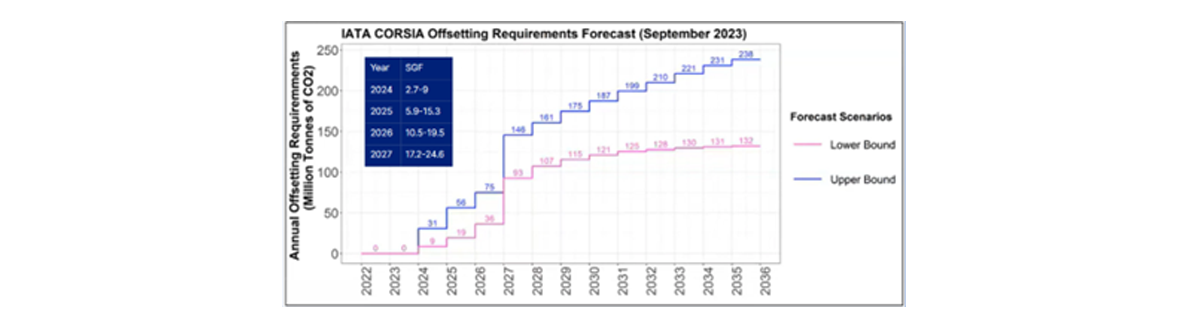

Annual Offsetting Obligations: CORSIA offset requirements are determined using the Sectoral Growth Factor (SGF), published by ICAO every October. The SGF indicates the annual increase in CO2 emissions compared to the baseline year. An airline's offset duty is based on its share of total international aviation emissions, adjusted by the SGF. Thus, airlines with higher growth rates have larger offset obligations, while those with lower growth or reduced emissions have smaller ones.

Phased Implementation: The scheme has been implemented in three phases. Until 2026, CORSIA will apply only to flights between states that have volunteered to take part.

Compliance Deadlines: The deadline to comply differs for each operating phase. Due to expected credit shortages and projected rising costs, participants should plan credit purchases well ahead to meet these deadlines and consider multi-year agreements to secure them.

Source: IATA

The Voluntary Carbon Market includes a diverse range of standards, each with unique eligibility criteria and registration methodologies. Standards manage registries that list and monitor carbon projects , and eventually retire the carbon credits generated from projects that either reduce or remove carbon dioxide from the atmosphere.

ICAO has recently conducted a review, resulting in the approval of two registries without any methodological exclusions. Additionally, eight other registries have received conditional approval, pending confirmation expected in March 2024. This conditional approval implies that while these standards are recognised for phase 1, they must meet certain additional criteria or conditions such as a restricted list of eligible methodologies . The updated list of approved registries is as follows:

Approved without exclusions:

Approved conditionally:

The expected demand for CORSIA-eligible credits is significant, with estimates ranging from 64 to 162 million units in phase 1. However, due to the limited number of approved registries, a supply shortfall of credits is anticipated. This is further exacerbated by the growing interest from non-airline entities, where some regard CORSIA credits as a baseline quality standard for their portfolios.

Source: IATA

The aviation industry faces challenges due to the competition for CORSIA-eligible carbon credits, market uncertainties, and the status of approved registries. The expected approval of more registries and methodologies in March (2024), including nature-based credits (not included in the pilot phase), could ease some of these market pressures.

For the reasons mentioned above, airlines must strategise well ahead of the January 2028 CORSIA compliance deadline and CFP can support operators with this task . By identifying and procuring CORSIA-compliant carbon credits, CFP Energy helps navigate the evolving market dynamics and regulatory changes, ensuring stakeholders secure compliant credits in anticipation of potential supply limitations and rising costs. Moreover, our provision of regular updates and insights into changes in regulations offers a clear understanding of compliance implications. Finally, CFP Energy’s analysis of the impact of CORSIA on the aviation industry and the carbon market equips businesses with the knowledge needed to stay competitive in this rapidly changing landscape.

On November 28, 2024 the UK government launched a consultation on expanding the scope of the UK Emissions Trading Scheme to include the maritime sector from 2026.

Increased government ambition, tighter regulations, greater corporate sustainability commitments, and the outcome of the international COP process will demand serious net zero action from large-scale organisations over the next decade and beyond.

The approval of Article 6 of the Paris Agreement at COP29 in Baku, marks a historic moment for global climate action. Article 6 introduces market-based mechanisms that enable countries to transfer emissions mitigations internationally to meet climate targets. After nine years of negotiations, nations have finalised the frameworks for its two main components, Article 6.2 and 6.4, fully enabling their implementation.