We're exhibiting at E-World | Register & Secure your Meeting

Germany, Essen | 11-13 February

Germany, Essen | 11-13 February

17 January 2024

Sam Wilson

Reduced over-the-counter carbon credit demand amidst methodological concerns and wider macroeconomic pressure, combined with over saturation of the supply side of the market have resulted in a widely illiquid secondary market. Bids for volumes are often circulated rapidly, and without previously locking in carbon credit supply at attractive levels, secondary market counterparties frequently struggle to make competitive offers. But there’s a simple way for end-buyers to avoid the challenges of the secondary market, and that’s by securing carbon credit volumes before they ever reach it.

Research by BeZero Carbon, a voluntary carbon market ratings agency (think Moody’s but for voluntary carbon projects), shows that roughly two thirds of carbon credits are pre-sold before they are even issued. It’s likely that many of these credits never reach the secondary market, and for the proportion that do, it’s almost a given that they reach the secondary market at an inflated price compared to early-stage investment levels.

So how can carbon credit buyers get direct access to a steady stream of high-quality carbon credits at attractive prices? It’s generally not an option for end-buyers to independently develop their own projects as carbon project development is a complex undertaking that requires:

The answer, then, is to work with a trusted counterparty that is directly involved in carbon project development. Counterparties such as this can facilitate exclusive access to carbon projects and give end-buyers an opportunity to enhance their carbon credit due diligence by providing valuable insights into project details. Furthermore, engaging with counterparties that have immediate access to carbon project investments allows end-buyers to lock in long-term future supply by structuring offtake or pre-sale agreements. Deals of this type can help to isolate end-buyers from the risk of future price increases and a dwindling supply of high-quality carbon credits, as demand continues to increase.

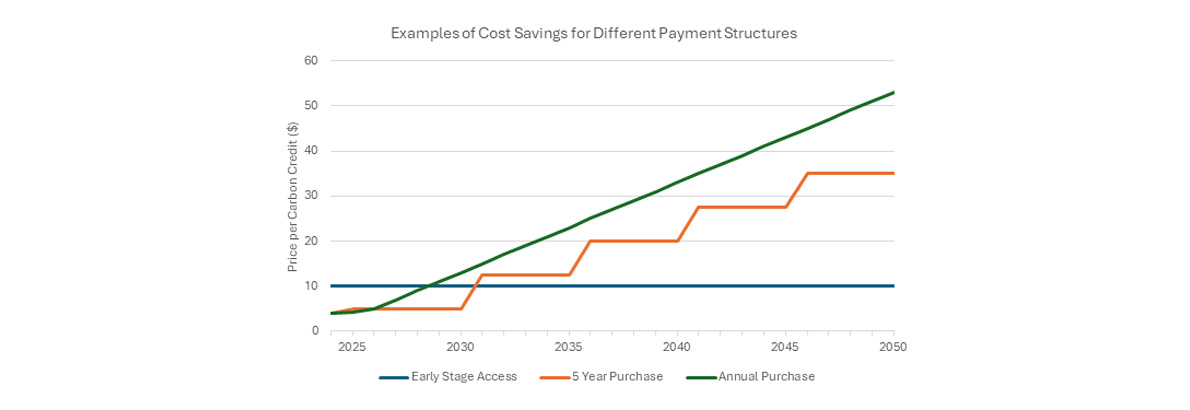

Figure 1: Example pricing scenarios for different carbon credit sourcing methods as credit prices increase. Scenarios included are locking in long-term pricing from early-stage access (directly from project investment), recurring five-year offtakes from carbon projects, and annual purchase of carbon credits. (Figures are arbitrary and not indicative of any specific credit-type.)

The voluntary carbon project investment scene has exploded over recent years, but there’s still some way to go. According to a recent report released by Trove Research (now a part of MSCI) carbon credit project investment totalled $36 billion between 2012 and 2022, with roughly half of this investment occurring in the last three years, and a further $3 billion in future investment already committed to developing voluntary carbon projects in the coming years.

Figure 2: Project-type breakdown for recent and future voluntary carbon project investment. Source: Trove Research

However, the report from Trove Research also notes that “the current rate of investment in carbon credit projects is only one-third of the level needed to deliver the volume of credits required by 2030 under the agreed upon 1.5 degrees Celsius goal”. It’s clear that more investment in carbon projects is needed if we are to mitigate the effects of climate change and prepare for a sustainable future, and CFP Energy are committed to facilitating this transition.

CFP Energy have been investing in carbon projects since 2007 and are uniquely positioned in the voluntary carbon market. As well as managing a spot portfolio and trading in the secondary market, we are actively investing in carbon projects with the goal of bringing the associated units to market and providing our clients with access to a long-term, high-quality supply of carbon credits. Our complete voluntary carbon offering allows us to work with clients to craft strategies that are aligned with their evolving sustainability goals. By leveraging our expertise and resources, we enable clients to effectively navigate the complexities of the carbon market, making informed decisions that benefit their immediate needs while also laying a robust foundation for future growth and sustainability.

On November 28, 2024 the UK government launched a consultation on expanding the scope of the UK Emissions Trading Scheme to include the maritime sector from 2026.

Increased government ambition, tighter regulations, greater corporate sustainability commitments, and the outcome of the international COP process will demand serious net zero action from large-scale organisations over the next decade and beyond.

The approval of Article 6 of the Paris Agreement at COP29 in Baku, marks a historic moment for global climate action. Article 6 introduces market-based mechanisms that enable countries to transfer emissions mitigations internationally to meet climate targets. After nine years of negotiations, nations have finalised the frameworks for its two main components, Article 6.2 and 6.4, fully enabling their implementation.