4 September 2024

CFP Energy

If you are ready to purchase carbon credits for compliance markets such as the EU ETS, UK ETS or voluntary carbon market, contact our team directly, here.

Otherwise, this guide will help you to understand key questions, such as; what is a carbon compliance market? And what is the best strategy for approaching carbon compliance for your business?

This webinar will provide you with specific commentary and insight from an industry-leading team of carbon market experts including Tim Atkinson, Director of Carbon Trading for CFP Energy.

A carbon market can be likened to a stock exchange, but instead of stocks being traded between two parties, carbon allowances or carbon credits are bought and sold.

The buyer of a carbon credit /allowance is an organisation that has done everything it can to reduce its carbon emissions but is still in breach of international and national regulations.

For example, if a car manufacturer emits 10,000 tons of carbon dioxide into the atmosphere and it is only allowed to emit 5,000 tons a year as per regulations, the organisation will need to purchase 5,000 credits from a carbon market to comply with legal obligations, set by regulations such as CORSIA, Article 6 of the Paris Agreement.

It may sound simple enough, but the cost of carbon credits/ allowances changes daily, and there are a variety of carbon markets around the world, each covering different geographies and regulating different kinds of credits together.

The biggest difference is between carbon compliance and voluntary carbon markets, which we will explore further in the guide, however, there is a binding commonality between the two.

Carbon credit and carbon allowance prices move up and down based on supply and demand, geopolitical events, the publication of legislation and even the amount of renewable energy that is generated in one country compared to another.

These forces act on every carbon market, meaning that careful consideration and deep analysis is required before a company makes a significant purchase. This is where CFP Energy provides its value. With a global team of experts who measure and track international and local events, accurate forecasting, risk management and carbon credit purchases can be made with the highest degree of certainty and security.

But as beneficial as this all is for businesses, what impact do carbon markets have on the environment, nature and the battle to mitigate climate change?

The best, and most clear example of the impact of carbon markets on nature, can be demonstrated by the voluntary carbon market (VCM). However, in name and nature, the VCM market is not mandatory for businesses to engage with, which is where the first key distinction is made vs compliance carbon markets, in which certain businesses face mandatory involvement.

We will explore these key issues throughout the rest of this guide, but if you would like to connect with our team, please connect here.

Understanding Compliance Carbon Markets

Compliance carbon markets are structured systems designed to reduce greenhouse gas (GHG) emissions by enforcing limits and providing economic incentives for companies to decrease their carbon footprint.

These markets are an essential part of carbon compliance, which refers to the adherence to regulations and standards aimed at controlling and reducing GHG emissions.

Unlike voluntary carbon markets, where companies participate out of a desire to offset their emissions without any legal obligation, compliance carbon markets are mandatory. They are established by regulatory authorities, such as governments or international bodies, to ensure that specific emission reduction targets are met.

A compliance carbon market is a regulated system where a governing body sets a cap on the total amount of greenhouse gases that can be emitted by covered entities, such as industries or power plants.

The EU ETS is the system in place for Europe, while the UK ETS was launched post Brexit as British companies were no longer under the influence of European regulations.

The regulatory framework typically involves setting an overall emission limit or cap for a specific period. Companies receive or purchase emissions allowances, which represent the right to emit a certain amount of carbon dioxide or its equivalent. These markets operate under a legal framework that mandates participation from certain sectors, ensuring that they meet their carbon compliance obligations.

Compliance carbon markets function primarily through cap-and-trade systems. In this system, a regulatory body sets a cap on the total GHG emissions allowed, and companies are allocated or can purchase emissions allowances corresponding to this cap. Each allowance permits the holder to emit one ton of carbon dioxide or its equivalent.

If a company emits less than its allotted amount, it can sell its surplus allowances to other companies that exceed their limits, creating an economic incentive to reduce emissions. This trading mechanism encourages companies to innovate and reduce their emissions cost-effectively. The cap is gradually lowered over time, tightening the supply of allowances and driving further emission reductions.

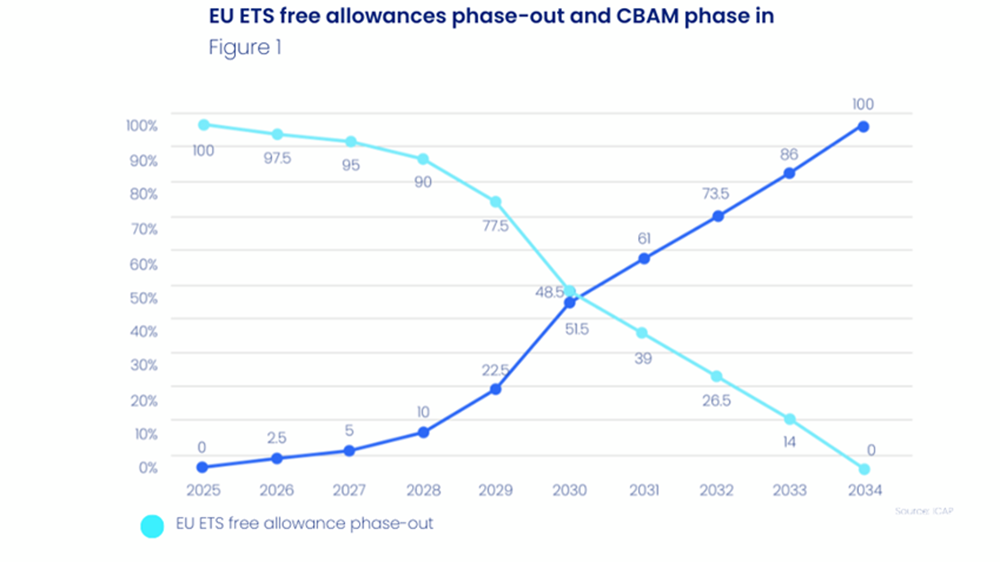

The European Union (EU) is gradually phasing out free allowances under its Emissions Trading System (ETS) as part of its climate strategy. This move aims to increase the financial incentive for industries to reduce their carbon emissions by making pollution more costly. To address the risk of carbon leakage—where companies might move production to countries with less strict environmental regulations—the EU is introducing the Carbon Border Adjustment Mechanism (CBAM).

CBAM is designed to equalise the carbon cost for both EU producers and foreign competitors by imposing a carbon price on imports from regions without similar climate policies. As the free allowances under the ETS are reduced, CBAM will be gradually introduced, starting from 2026.

Initially, it will apply to high-carbon sectors such as cement, iron, steel, aluminium, and fertilisers. This combined approach is intended to bolster the EU's climate goals while safeguarding domestic industries and promoting global emission reductions.

The UK is set to follow suit and mirror EU regulations, as HMRC concluded an industry-wide consultation on UK CBAM earlier this year.

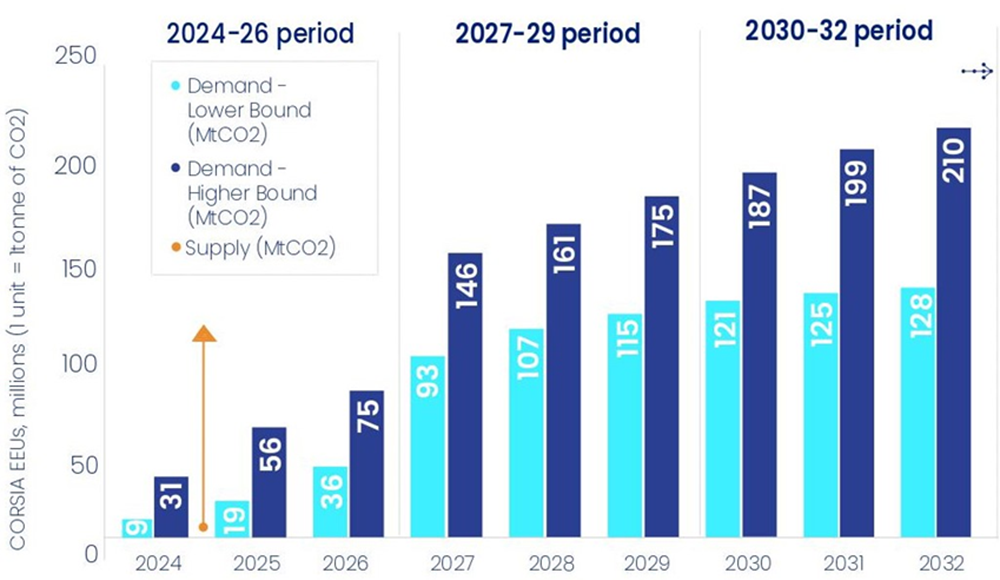

The Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) is a global initiative by the International Civil Aviation Organization (ICAO) aimed at addressing the aviation sector's carbon emissions. CORSIA requires airlines to offset their carbon emissions by purchasing carbon credits from approved projects, effectively capping the sector’s net emissions at 2020 levels.

CORSIA integrates with existing carbon compliance frameworks by allowing airlines to meet their obligations through participation in carbon markets. This linkage enables airlines to buy carbon credits from various projects that reduce or remove carbon emissions, such as reforestation or renewable energy initiatives.

CORSIA complements other carbon compliance systems by creating a market-driven approach to managing aviation emissions. It helps align the aviation sector with broader climate goals, providing a flexible mechanism that incentivises emissions reductions while offering a pathway for the industry to participate in the global carbon market and contribute to global climate efforts.

Several major compliance carbon markets are operational worldwide, with the European Union Emissions Trading System (EU ETS) being one of the most prominent. The EU ETS, established in 2005, covers a wide range of industries and is the largest compliance carbon market globally.

Another significant example is the California Cap-and-Trade Program, which started in 2013 and applies to power plants, industrial facilities, and fuel distributors.

These markets demonstrate how compliance carbon markets can effectively drive down emissions by combining regulatory enforcement with market-based mechanisms. As climate change becomes an increasingly urgent issue, compliance carbon markets are likely to play a pivotal role in global carbon compliance efforts.

In compliance carbon markets, companies face a critical choice between buying carbon credits and directly reducing their emissions. Purchasing carbon credits can be a cost-effective short-term solution for meeting regulatory requirements, especially when the price of credits is lower than the cost of reducing emissions internally.

However, relying too heavily on carbon credits may delay necessary investments in cleaner technologies and sustainable practices. While compliance through credit purchases ensures adherence to regulations, it may not contribute to long-term environmental goals. Conversely, investing in emission reductions can lead to lasting sustainability but may require significant upfront costs and adjustments to business operations.

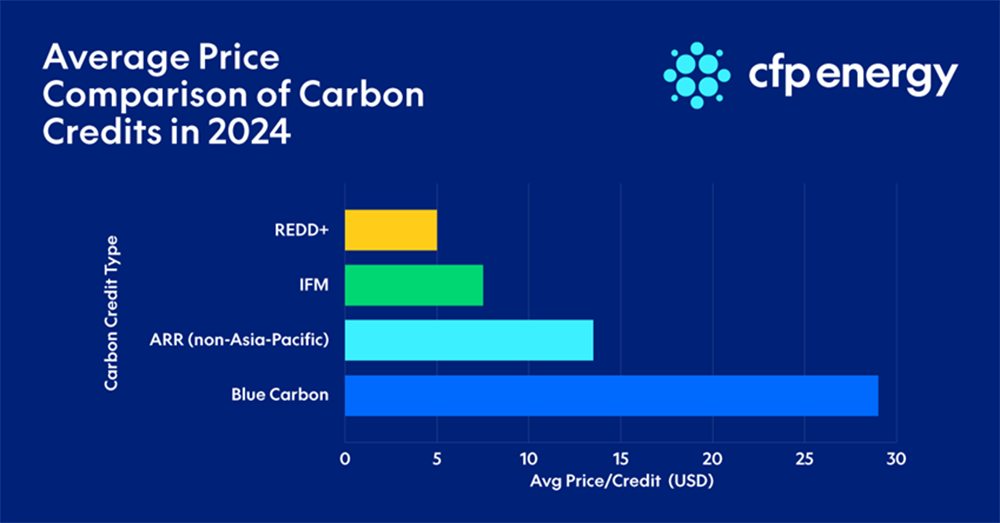

A voluntary carbon market is a system where businesses, organisations, and individuals can purchase carbon credits to offset their greenhouse gas (GHG) emissions voluntarily, without any regulatory obligation.

Unlike compliance carbon markets, which are mandated by governmental bodies and have strict regulatory frameworks, voluntary carbon markets operate on a self-regulatory basis. Participants in these markets typically seek to demonstrate environmental responsibility, enhance their sustainability credentials, or meet corporate social responsibility (CSR) goals.

The flexibility of voluntary carbon markets allows a broader range of participants, including those not covered by compliance markets, to take part in the fight against climate change.

Voluntary carbon markets offer several advantages. For businesses, participating in these markets can enhance brand reputation, attract environmentally conscious consumers, and differentiate them from competitors. They also provide a way to achieve carbon neutrality, which can be a valuable marketing tool.

For individuals, voluntary carbon markets offer a tangible way to contribute to environmental sustainability by offsetting their personal carbon footprints, such as those from travel or energy use. Additionally, voluntary markets often support projects that deliver co-benefits, such as biodiversity conservation, social development, and job creation in local communities, making them appealing to participants who want to contribute to broader sustainability goals.

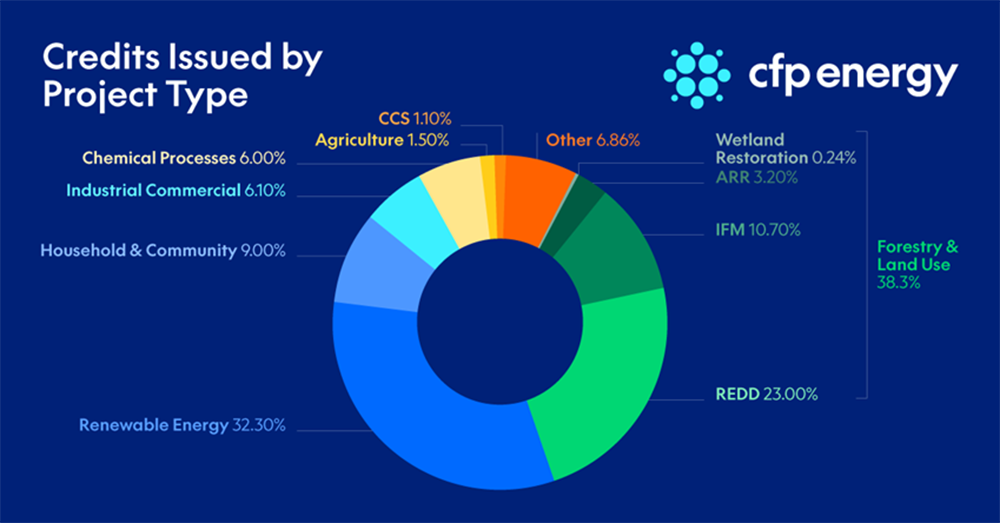

Nature Based Solutions & Approaches with Technology for Carbon Removal Clean cookstove projects are a significant part of the Voluntary Carbon Market (VCM), where they contribute to carbon reduction and community development. Traditional cooking methods, often relying on open fires or inefficient stoves, lead to substantial carbon emissions and health problems due to smoke inhalation. Clean cookstove projects provide more efficient stoves that burn less fuel, reducing carbon emissions and improving air quality.

In the VCM, these projects generate carbon credits by quantifying the emissions avoided through the use of improved stoves. Companies and individuals can purchase these credits to offset their own carbon footprints, directly supporting the deployment of clean cookstoves in communities. This not only contributes to global carbon reduction efforts but also benefits local communities by reducing health risks and saving time and money on fuel collection.

However, combating climate change requires a combination of carbon prevention projects, like clean cookstoves, and carbon removal initiatives, such as reforestation and soil carbon sequestration. Preventing emissions from entering the atmosphere is crucial, but so is actively removing existing carbon. This dual approach is essential for addressing the complexity of climate change, which demands both global and localised efforts.

The challenge is immense and multifaceted, requiring the collaboration of governments, businesses, NGOs, and communities worldwide. Success depends on innovative projects that address local needs while contributing to global climate goals, demonstrating that a collective effort is essential to tackling one of the most pressing issues of our time.

The integrity of voluntary carbon markets hinges on the verification and certification of carbon credits. To ensure that purchased credits represent genuine emission reductions, several internationally recognised standards have been established.

Verra and the Gold Standard are two of the most prominent organisations in this space. These standards set rigorous criteria for project design, monitoring, and reporting, ensuring that carbon credits are credible and provide real environmental benefits. Verified credits must undergo third-party audits to confirm that the claimed reductions are accurate and additional, meaning they would not have occurred without the project’s intervention. This verification process is crucial for maintaining trust in the market and ensuring that investments in carbon credits contribute effectively to global emission reduction efforts.

CPF Energy is working to lead the voluntary carbon market and provide large organisations with clarity and confidence throughout the process of purchasing voluntary carbon credits.

Our team has visited carbon capture projects all over the world, ensuring their impact is fully verified and nature is being protected, allowing natural processes to take place and remove carbon from the atmosphere.

There are significant challenges to prove the effectiveness of the market, however, significant changes and steps continue to be made year on year.

We work closely with businesses around the world, connecting them to projects that align with climate goals and that require support most.

To learn how we can support your long-term decarbonisation goals with access to the voluntary carbon market, get in touch here.

| Aspect | Compliance Carbon Markets | Voluntary Carbon Markets |

| Regulation | Mandatory, regulated by government bodies | Voluntary, self-regulated by participants |

| Participants | Sectors with legal emission reduction obligations | Any business, organisation, or individual |

| Objective | Meet legal emission reduction targets | Offset carbon footprint voluntarily, enhance sustainability |

| Flexibility | Limited; must follow strict regulatory guidelines | High; can choose projects and credits that align with values |

| Cost | Costs may be higher due to legal obligations | Often more flexible in pricing |

| Market Size | Typically larger, covering major industries and sectors | Smaller but growing, diverse participants |

| Carbon Credits | Emission allowances often capped and traded within the system | Carbon offsets from various projects, verified by standards |

| Verification | Enforced by regulatory authorities | Verified by third-party standards like Verra or Gold Standard |

| Long-term Impact | Drives systemic change through enforced reductions | Encourages innovation and broader participation in sustainability |

Combining compliance and voluntary carbon market strategies can be an effective way for organisations to meet both legal obligations and demonstrate environmental leadership. For instance, a company required to participate in a compliance market can also engage in voluntary markets to offset any emissions beyond their legal requirements or to support specific sustainability projects that align with their corporate values.

This hybrid approach allows companies to not only meet regulatory standards but also enhance their public image, appeal to environmentally-conscious consumers, and contribute to global sustainability efforts in a more holistic way.

Selecting the appropriate carbon market strategy depends on an organisation's goals, industry, and regulatory environment. For companies subject to legal emission caps, participating in a compliance market is non-negotiable. However, even these companies can benefit from engaging in voluntary markets to support additional sustainability initiatives or to offset emissions in areas not covered by compliance regulations.

For businesses and individuals not bound by legal requirements, voluntary markets offer a flexible and impactful way to manage their carbon footprints.

It’s essential to assess your organisation’s long-term sustainability goals, budget, and desired impact when choosing between compliance, voluntary, or a hybrid approach. Consulting with experts in carbon management can also help navigate the complexities and maximise the benefits of participating in these markets.

The landscape of carbon markets is evolving rapidly as global awareness of climate change intensifies and the urgency for effective mitigation strategies grows. Across multiple industries, regulations are becoming more stringent and greater demands are being placed on organisations that have the highest levels of emissions. The EU ETS will see major expansion over the next four years and significantly will fall onto the price of carbon allowances as demand is likely to soar.

Both compliance and voluntary carbon markets are poised to play increasingly significant roles in achieving global emission reduction targets, driving innovation, and fostering sustainable economic growth.

Compliance carbon markets are expected to expand as more countries and regions implement or tighten carbon pricing mechanisms to meet international climate commitments, such as those outlined in the Paris Agreement. The success of established markets, like the European Union Emissions Trading System (EU ETS) and the California Cap-and-Trade Program, serves as a model for emerging markets in Asia, Latin America, and Africa. Additionally, as the cap on emissions is gradually lowered over time, these markets will likely see increased trading activity and higher carbon prices, further incentivising companies to reduce their carbon footprints and invest in clean technologies.

On the voluntary side, carbon markets are gaining traction as more businesses and individuals recognise the importance of offsetting their emissions beyond regulatory requirements. With growing consumer demand for sustainable products and corporate social responsibility, voluntary markets are expected to see substantial growth.

This expansion will be driven by innovation in carbon offset projects, such as reforestation, renewable energy, and carbon capture technologies, as well as the development of new standards and methodologies that enhance the credibility and transparency of carbon credits.

The evolution of carbon markets holds significant potential for mitigating climate change. Compliance markets create a strong regulatory framework that compels major emitters to reduce their emissions, leading to systemic change across industries. Voluntary markets, meanwhile, encourage broader participation and innovation, allowing businesses and individuals to contribute to global emission reduction efforts.

There are numerous transparency issues associated with voluntary carbon markets, however, governments around the world are working hard to introduce legislation to improve standards and ensure climate finance is funneled into projects that can benefit most.

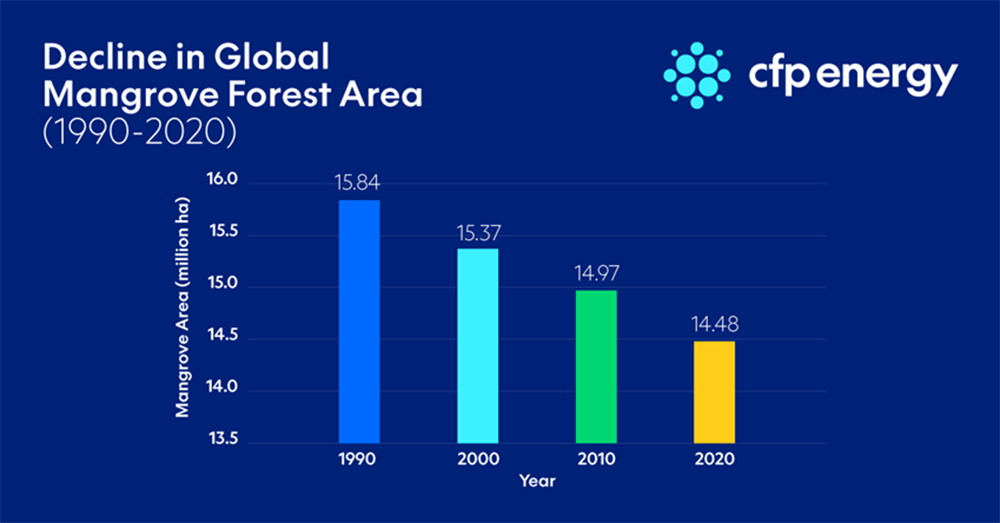

The requirement is significant for many different ecosystems, such as mangrove forests, which are amongst the most important natural barriers to climate change. However, as shown in the graphic below, their degradation over the last 35 years has been significant and their protection has become critical.

Together, these markets can accelerate the transition to a low-carbon economy by providing financial incentives for emission reductions and supporting the development of new technologies and sustainable practices.

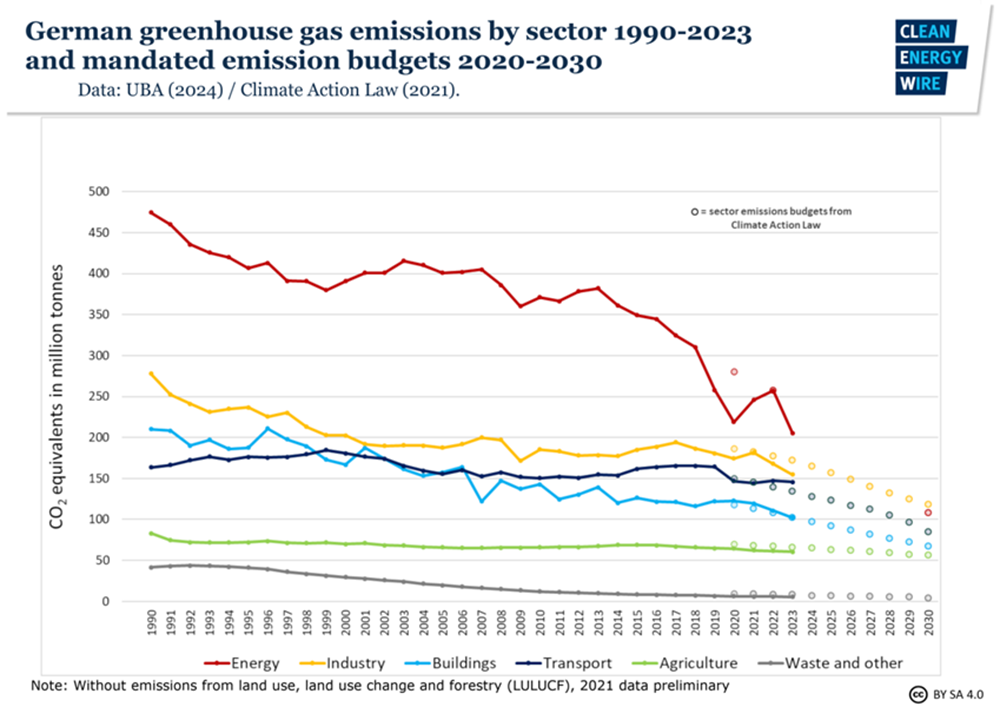

Germany, as the largest carbon emitter in Europe, plays a crucial role in shaping both national and European carbon compliance regulations. At the national level, Germany implements the National Emissions Trading System (nEHS), which targets sectors not covered by the EU Emissions Trading System (ETS), such as buildings and transport.

“For companies that are not covered by the European regulations, but are covered by the nEHS, there is likely to be a lack of understanding of the complexity and potential financial liability of a carbon compliance scheme. We operate across Europe and have a deep understanding of how these markets work and how the cost of allowances can rapidly change,” Vanessa Kükenthal, nEHS specialist for CFP Energy.

The nEHS sets a fixed carbon price that gradually increases, incentivizing smaller businesses and sectors to reduce their emissions over time. This complements the EU ETS, which applies to large industrial emitters and the power sector, requiring them to buy allowances for their emissions, with the cap decreasing annually.

Germany's approach to carbon regulation exemplifies how leading nations can drive decarbonisation while balancing economic growth. By aligning national and European efforts, Germany ensures that businesses of all sizes contribute to emissions reductions. This dual approach helps the country to decarbonise gradually, maintaining competitiveness while progressing towards climate targets.

Germany's leadership in carbon legislation serves as a model for other nations, particularly in demonstrating how to integrate local and regional regulations effectively. As a key player in the EU, Germany's robust carbon policies encourage other developed countries to adopt similar strategies, showing that economic strength and environmental responsibility can go hand in hand.

This leadership is vital in galvanising global efforts, particularly among developing nations, to combat climate change.

Once more, CPF Energy is amongst Europe’s leaders in carbon markets and carbon compliance and our team provides support to some of the largest organisations on the continent.

Decarbonisation and navigating carbon markets and carbon regulations is a highly specialised and complex task, and one that is set to become even more difficult as the need to reduce emissions becomes greater and greater.

Across compliance and voluntary carbon markets, our team has the experience, knowledge and confidence to provide you with long-term carbon strategies that are balanced with your commercial requirements.

For more information and to access carbon credits, contact our team, here.

In 2016 The International Civil Aviation Organization (ICAO) adopted a variety of measures demanding material and operational efficiency upgrades from aviation operators. As one branch of these measures, the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) began in 2021, as a lever to mandate offsetting of CO2 emissions and incentivise uptake of Sustainable Aviation Fuels (SAF).

CFP Energy and Brook Green Supply, both part of the CFP Energy Group, are proud to announce their success in retaining their respective EcoVadis Bronze and Silver awards. EcoVadis is the world's largest and most trusted independent provider of business sustainability ratings.

26 June 2024 London - Last night Jonathan Navon and Thomas Rassmuson, Founders of CFP Energy, received the 'Team of Transition Champions' Award at Reuters' Global Energy Transition Awards 2024.