We're exhibiting at E-World | Register & Secure your Meeting

Germany, Essen | 11-13 February

Germany, Essen | 11-13 February

20 August 2024

George Brown

As nEHS specialists, Patrick Rodzki and Vanessa Kükenthal support the long-term decarbonisation initiatives of organisations across Germany, providing regulatory guidance and key market insight to ensure businesses achieve their goals in a cost-effective and efficient manner.

“Businesses need help to navigate the nEHS but also with their wider energy transition plans because regulations are going to get tighter and tighter in Germany and across the entire European Union. If businesses don’t plan accordingly, governments are going to come down hard.” said Patrick.

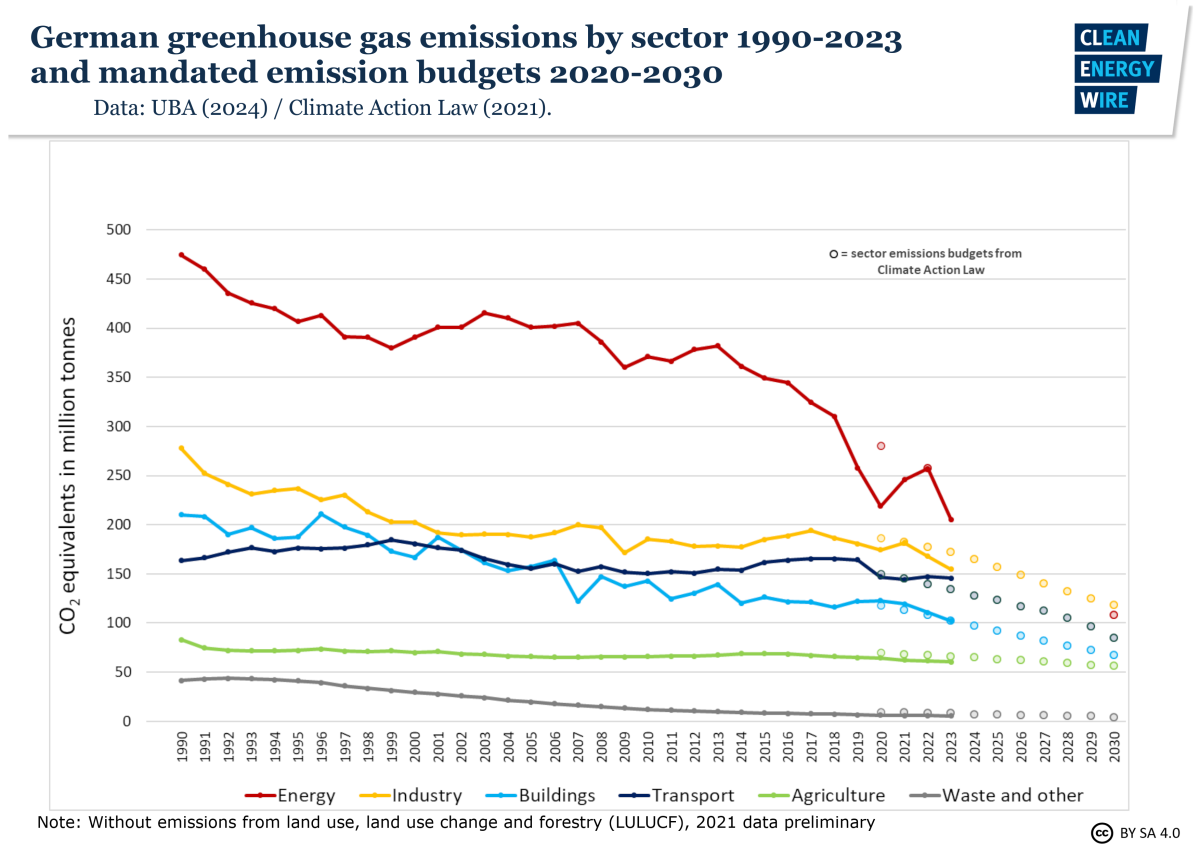

Germany is the highest emitter of carbon dioxide in the European Union with nearly 572 million metric tons produced over the course of 2023.

The country is responsible for a quarter of the EU’s total C02 emissions, which primarily comes from burning fossil fuels for energy use.

The manufacturing and private sector is also amongst the highest emitting in the European Union, though a gradual reduction has been taking place over the past 30 years.

However, despite the cutbacks, major reductions in carbon emissions are still required if climate targets are to be achieved.

Germany has set targets of reducing greenhouse gas emissions by a minimum of 65% by 2030, which includes targets for the industrial sector. The Federal Minister for Economic Affairs and Climate Action, Robert Habeck recently said:

“The development in the individual sectors shows a heterogeneous picture: the energy, industry, agriculture, waste management and other sectors are overfulfilled. The transport and, above all, the buildings sectors show an improved trend compared to previous projections. However, they fall short of their previous sector targets. As emissions in the transport and buildings sectors are decisive for the EU Effort Sharing Regulation (ESR), this also means that Germany could miss its targets by 2030 without further action.”

The nEHS is a carbon scheme that is only in operation in Germany, while the ETS covers the whole of Europe apart from the UK, which maintains its own ETS scheme.

The nEHS offers Germany companies the opportunity to buy allowances at a fixed price of €45 (rising to €55 from 2025).

“Right now, companies can purchase allowances with price certainty and there is no volatility in the marketplace.” Said Vanessa.

“But that will all change in the near future and companies in Germany that are covered by the nEHS need to make appropriate hedging decisions before prices inevitably increase in the near future. We can see how price fluctuations in the cost of allowances in the EU ETS and UK ETS can catch businesses off guard and they end up paying millions of euros more than they anticipated.”

“For companies that are not covered by the European regulations, but are covered by the nEHS, there is likely to be a lack of understanding of the complexity and potential financial liability of a carbon compliance scheme. We operate across Europe and have a deep understanding of how these markets work and how the cost of allowances can rapidly change.”

.png)

The nEHS mainly covers sectors not included in the European Union Emissions Trading System (EU ETS). These sectors include buildings, transport, and small installations such as heating systems in residential and commercial buildings and fuels for transportation.

Companies in the affected sectors must register with the German Emissions Trading Authority (DEHSt) and report their emissions annually. The obligation applies to those whose activities result in the emission of carbon dioxide (CO₂) and, potentially, other GHGs.

The nEHS imposes a carbon price on these emissions. This carbon price is set by the German government and started with a fixed price per ton of CO₂ in the initial years, gradually increasing each year. This will transition to an auction-based system over time.

There might be specific thresholds below which smaller emitters are exempt from participation. However, larger emitters within the covered sectors are required to comply fully.

Covered organisations must fulfill various administrative obligations, including monitoring and reporting emissions, acquiring and surrendering emissions allowances, and complying with verification and auditing requirements.

Non-compliance with the nEHS obligations, such as failing to surrender enough allowances to cover emissions, can result in financial penalties.

CFP Energy supports some of the largest manufacturing and industrial organisations in Europe with decarbonisation strategies and execution, while also delivering energy transition products to help businesses navigate the complex regulatory environment, “Our DNA is the EU ETS,” says Patrick.

“Nobody knows what is going to happen from 2027 onwards because the UK and EU ETS markets may merge, and this may have further implications for the nEHS in Germany. We also anticipate that the nEHS will be expanded across Europe as is often the case the environmental regulations that are developed in Germany.”

“The bottom line is that regulations are expanding in scale and scope, as methane is included in the nEHS but not the EU & UK ETS. We’re confident this will soon change as methane has a greater impact as a GHG than carbon dioxide.”

“As market specialists, we’re in constant dialogue with regulators and will be the first to know about the impact that new legislation will have on carbon markets and therefore, organisations across Europe and Germany, we want to protect the planet but also the long-term health of our partners and clients from a commercial standpoint.”

“There is a paradigm shift coming and unless businesses are equipped with the correct knowledge, strategy and long-term environmental planning, they may not be able to navigate the incoming squeeze of carbon regulations.”

To connect with Patrick and Vanessa and discuss the impact of the nEHS, get in touch, here.

Decarbonising the Future: ETS Reforms & Net Zero Solutions - The latest industry report from CFP Energy features the insights of John Booth as well as the results of a survey of data centres across the UK, France and Germany. Operators were questioned on their net zero progress and future outlook for decarbonising their operations.

On November 28, 2024 the UK government launched a consultation on expanding the scope of the UK Emissions Trading Scheme to include the maritime sector from 2026.

On November 28, 2024 the UK government launched a consultation on expanding the scope of the UK Emissions Trading Scheme to include the maritime sector from 2026.